Is betting on Nykaa worth?

The future of online commerce in the fastest growing economy of the world

Greetings, In this deep dive we will explore the business of Nykaa. I will take you through

- The background of the promoters

- Outlook of the industry

- Financials of the company

- IPO details

- Conclusion and my conviction

Let's keep this simple

The Background of the Promoters

Nykaa is promoted by the Nayar family — Sanjay Nayar, Falguni Nayar and their two children — Anchit Nayar and Adwaita Nayar.

Together the family owns about 54.25% of the entire company and will continue to own above 51% stake, post its IPO.

Sanjay Nayar is the Chairman and CEO of the Indian arm of the private equity giant, KKR.

Falguni Nayar was the Managing Director at Kotak Mahindra Investment Banking, leading the team that took various companies public.

Anchit Nayar was a Vice President at Morgan Stanley Equity Research and

Adwaita Nayar has worked with several consulting and investment banking giants.

Out of four, three members of the family work with Nykaa full time.

Beauty and Personal Care Industry

Nykaa operates in a segment of the retail industry known as BPC or Beauty and Personal Care. This segment is part of the discretionary retail industry in India, which is set to reach Rs 31 Trillion by 2025.

Fashion and BPC combined, accounts for 35% of the total discretionary retail pie. This is a large enough market for Nykaa to foray into and grow further.

Before Nykaa started in 2012, India’s BPC industry was fragmented. There was a clear divide in the industry. On one hand you had these hi-retail luxury stores that were present far and few in Tier 1 cities or at airports catering to only the elite, and on the other hand you had customers in Tier 2 and 3 cities buying from small stores that had a limited selection of products available to choose from.

There was a clear gap in the options available to the target consumer — women, esp. the ones residing in Tier 2 and Tier 3 cities and towns across India. In 2012, online commerce had just started a few years earlier but was laded with fake products being sold or just like the small stores, didn’t have everything a customer wanted.

This unseen gap in the industry is where Falguni Nayar saw opportunity.

2020 was a transformational year for internet economy and organized retail.

Today, organized retail is almost 20% of the entire market and growing fast.

Indian retail industry is estimated to grow at a CAGR (compound annual growth rate) of 11% till 2025.

Of this, the BPC segment will grow faster at a CAGR of 12%+. Share of unorganized retail is reducing in this segment from 77% in 2016 to 70% in 2020.

Within the BPC segment, the online growth is much faster at 30%+ CAGR with a long runway ahead. The penetration of online BPC sales in India stands at 6% compared to almost 35% in China and 20% in US.

Two major factors that are helping the online markets grow faster than the industry are — trust and large catalogue of products.

This is reflected in the data as well, which clearly shows that demand from Tier 2+ cities is growing much faster than demand from Metro and Tier 1 cities.

India Fashion Market

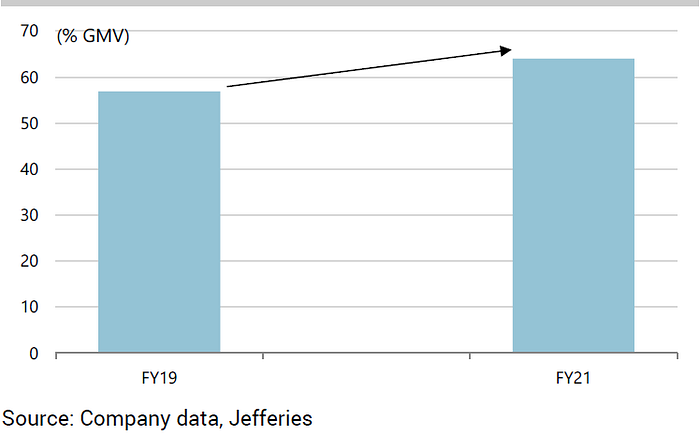

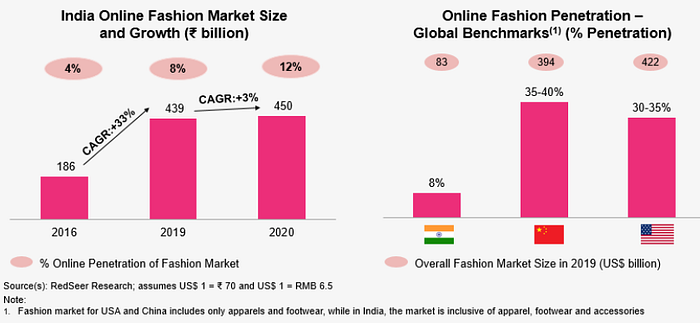

The other market that Nykaa is exploring into is Fashion. Here too, similar forces, of the move away from unorganized retail to organized retail is helping the company. Organized retail share of the overall market was 29% in 2016, this share jumped to 38% in 2019 and is growing fast.

Shift of demand from offline to online is providing tailwinds for companies like Nykaa. Online fashion sector grew at a CAGR of 25% in last four years, Covid has accelerated this growth further.

India’s online fashion penetration is still only 8% compared to 40% in China and 35% in US, indicating that there is a lot of room for further growth.

Nykaa’s Business

Nykaa is an omni-channel vertical e-commerce company, i.e., the company has presence both offline and online and only sells products in a single category, unlike e-commerce companies like Flipkart and Amazon that sell everything.

It is this focus at verticalization that gave Nykaa its edge. Today, Nykaa is the undisputed market leader in Beauty and Personal Care products across India.

It started in 2012 with this category as it was relatively easy to disrupt it and most competitors weren’t focusing at building a vertical e-commerce company.

Margins are easy to protect in Beauty and Personal Care products given cosmetics have the highest mark up of any consumer product in the world.

This is also the reason why Nykaa didn’t have to raise a lot of money from private investors (it has raised less than ~$350 Million) and the equity dilution isn’t as much as other startup businesses that are going public (Nayar Family and founders still holds 54% of equity compared to less than 5% for companies like Zomato and PolicyBazaar).

When Amazon was taking shape, Jeff Bezos used a similar playbook. He started Amazon as an online book store as it was easier to manage and ship books online — books weren’t perishable items and most books come in standard sizes. Once he had built the infrastructure required for shipping books, he could easily start selling and shipping other items. Today, couple of decades later, Amazon sells everything.

Nykaa in a way is following the same path that Amazon once charted upon. What began as an omnichannel beauty and personal care business is now slowly morphing into a lifestyle platform.

Nykaa’s entry into fashion and apparel is a step towards this direction.

Optionality

If you double the number of experiments you do per year you’re going to double your inventiveness — Jeff Bezos

Nykaa has built a platform, now it has the luxury to experiment with it and build new lines of businesses. The great part about these experiments is that, none of them require large capital expenditures and Nykaa can change and adapt with them quite nimbly.

Here are few experiments that Nykaa is running on its platform as of 2021:

Nykaa Man

Nykaa Man is targeted at, you guessed it, Men. The company operates this business via a separate app and website. There are several categories of products offered ranging from gadgets, tech accessories, personal care, fashion, health and even nutrition.

The Global Store

The Global Store is Nykaa’s offering to buy luxury foreign brands from overseas retailers. These brands usually do not have a presence in India either in offline or online segment and their partnership with Nykaa is the only way customers can buy them in India.

Nykaa Pro

Nykaa Pro is a membership program for beauty professional and make up artists around the country. There are several beauty and personal brands in the world that are ‘Professional Only’. Members of Nykaa Pro can order these brands from Nykaa and also get the relevant expert training along with educational content to help them in their professional journey.

SuperStore

SuperStore is Nykaa’s entry into B2B segment. Via SuperStore, Nykaa wants to sell BPC products to select offline and local retailers. Nykaa’s exploring into this segment makes sense as the company’s logistic and warehouse capability has reached a stage where it can effectively supply products to other retail chains.

Nykaa’s Financials

Unit Economics

What makes Nykaa stand out amongst the Indian start up community, is that Nykaa is unit economic positive. It makes a profit on every order it ships via its platform. This profit should grow further as business scales and costs of additional business via the platform reduces dramatically.

Nykaa makes a profit of about ~Rs 250 to Rs 300 per average order value of ~Rs 2000, in the BPC Category.

Per unit economics for Nykaa Fashion aren’t clear yet as its relatively new. The fashion and apparel business is ramping up fast though and should significantly contribute towards revenues and unit economics in FY22.

Sales and CAGR

Nykaa has compounded it’s annual sales at an unbelievable CAGR of 84% per year since 2017. This growth wasn’t even impacted to a large extent in FY20 and business recovered very soon post the aftermath of Covid.

Nykaa works on an inventory led model — it buys the products from various suppliers and brands globally based on the demand and then sells the product to customer via its platform. In each transaction, Nykaa acts as the direct seller unlike at Amazon where the customer is purchasing an item from a third party seller.

Bulk of Nykaa’s revenue (~90%) comes from this channel. Any discounts and promotions by specific brands is passed on directly to the consumer and doesn’t effect Nykaa’s bottom line.

The other ~10% of revenue is split between rendering marketing support to brands, commissions from the limited number of third party brands who sell on Nykaa’s platform and the delivery and shipping fees charged to the customers.

Profit and Margins

The gross margin for the business remain steady at a little over 40%, while EBITDA margins are inching higher from -23% in FY17 to ~6.6% in FY21.

The company closed FY21 as its first year of PAT breakeven.

Cash Flow

The company’s cash flow from operations has significantly improved from a negative Rs 997 million in FY17 to a positive Rs 1498 million in FY21.

There is significant operating leverage built into the business and as the company scales further, this should increase disproportionately.

In FY21, Nykaa turned both Cash Flow from Operations and Free Cash Flow positive — a rarity among e-commerce companies.

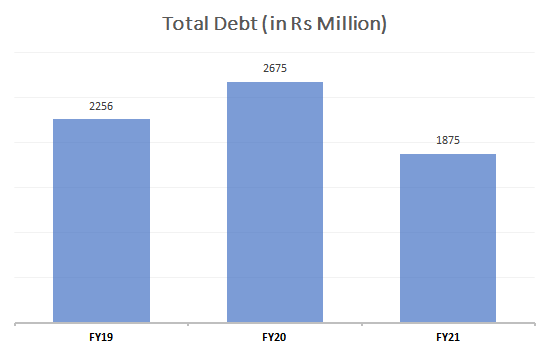

Debt

The company’s net debt to equity ratio has reduced at an accelerated pace, as it has raised substantial cash via recent funding rounds.

Net Debt to Equity ratio declined to a negative (0.1) in FY21, indicating that the company has more cash on its books than debt.

Total debt for the company stood at Rs 1,875 million in FY21 compared to Rs 2,256 in FY19 (a reduction of ~17%).

About The IPO

Nykaa filed its draft prospectus with the regulator on 3rd Aug 2021. The company will publicly list in India on both NSE and BSE.

IPO date will be 28th October

Current Shareholding Structure

As mentioned earlier, promoters of the company (the Nayar family) together holds 54% stake in the entire company.

Some other noteworthy investors in the company include Sunil Kant Munjal of Hero Group, venture funds like TPG Growth, Steadview Capital and Lighthouse India and late stage funds like Fidelity.

Here is the list of shareholders that will be selling part of their stake in the company upon listing.

Major Milestones

Below are some of the major milestones of the company mapped in the form of a timeline.

What will the proceeds of IPO be used for?

The company plans to use bulk of its proceeds for enhancing its brand visibility and repaying a significant portion of its debt.

The company will also be using Rs 350 Million from the IPO to set up new retail stores for Nykaa Fashion. These stores will be about 75,000 square feet each and will be set up over the next three years till FY24.

All of these stores will be taken on a lease basis and the company does not own any of its existing stores.

This is a clear indication that the company expects to ramp up its fashion business significantly and sees it as the driver for major growth for the next 5 years.

Risks

Regulations

The biggest risk to Nykaa today is the impending regulation by Ministry of Consumer Affairs. All e-commerce platform companies are under scrutiny for selling private labels merchandize and as per draft regulations, Govt of India is mulling the option of banning platforms ability to sell any private label goods.

If this regulation is passed, it will hamper Nykaa’s investment into its own private label brands and result in some headwinds for the company. The company owns a portfolio of 13 private label brands as of 2021.

This regulation is still very much under development, so we do not know if and when it may be passed into law. The best way to tackle this risk is to keep a close eye on any new developments, esp. if you’re thinking of investing in the company.

Increasing Competition

The second biggest risk is the increased competition from new vertical e-commerce players. Both start ups and established companies are entering Nykaa’s turf and challenging it’s market share.

Myntra was the latest to announce its foray into Beauty and Product Category.

Then there are startups like Purplle, who have been trying to compete with Nykaa since the beginning.

Even though Purplle started before Nykaa, it has lost market share and struggled to keep up with Nykaa’s pace.

Though entry of these new players mean increased competition, I believe Nykaa will still be able to protect its market share, thanks to its content moat we discussed earlier.

Nykaa is more than a platform to its customers today, it’s a platform built on their trust.

Conclusion

Nykaa’s IPO represents a significant milestone for the Indian start up ecosystem. Successful e-commerce companies are rare, a profitable omnichannel retail platform is even rarer.

What excites me about Nykaa is the captain of this company — Falguni Nayar — and if I choose to invest, it will be because of my bet on her ability.

In a nutshell, this business has a great potential and also have pontential competitor's. and nykaa knows to tackle them.

If you like my work do like and subscribe.

See you in the next one.

peace ,

Sudhanshu .